Are you ready to embark on a journey that will transform your understanding of finance as we know it? Get ready to explore the fascinating world of crypto and discover how it is reshaping the future of finance. Read till the end to learn more about the disruptive potential of cryptocurrency.

What is Crypto and How Does it Work?

Cryptocurrency, or simply crypto, is a revolutionary digital form of currency that operates independently of any central authority. It relies on a technology called blockchain to record and verify transactions. Here’s a brief overview of how it works:

- Decentralization: Unlike traditional currencies controlled by governments and banks, cryptocurrencies are decentralized. They are maintained by a network of computers (nodes) spread across the globe, making them resistant to censorship and control.

- Blockchain Technology: The backbone of crypto is the blockchain, a distributed ledger that records all transactions in a transparent and immutable way. Each block in the chain contains a list of transactions, and once added, it cannot be altered.

- Cryptography: Cryptocurrencies use advanced cryptographic techniques to secure transactions and control the creation of new units. This ensures the integrity and security of the network.

Breaking Down these terms: CryptoCurrency, Blockchain, Smart Contracts

- Cryptocurrency: A digital or virtual currency that uses cryptography for security and operates independently of central authorities. Bitcoin, Ethereum, and Ripple are some of the most well-known cryptocurrencies.

- Blockchain: A decentralized and transparent ledger technology that underpins cryptocurrencies. It records transactions in a tamper-proof manner.

- Smart Contracts: Self-executing contracts with the terms of the agreement between buyer and seller directly written into code. They automate processes and eliminate intermediaries.

Evolution of Cryptocurrency

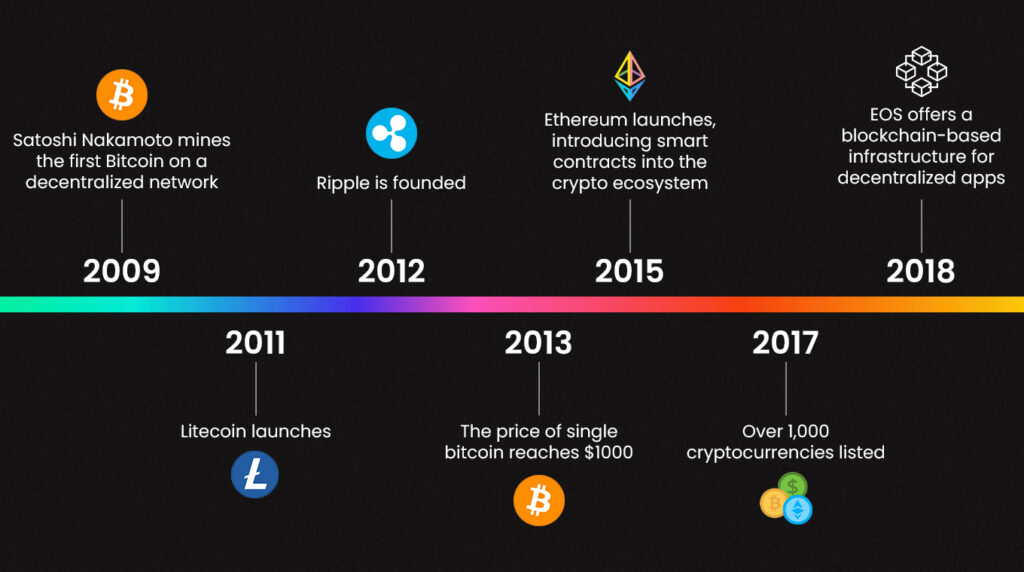

Crypto has come a long way since its inception in 2009 when Satoshi Nakamoto mined the first Bitcoin on a decentralized network. Here’s a snapshot of its evolution:

- 2009: Satoshi Nakamoto mines the first Bitcoin.

- 2011: Litecoin launches.

- 2012: Ripple is founded.

- 2013: The price of a single Bitcoin reaches $1,000.

- 2015: Ethereum launches, introducing smart contracts into the crypto ecosystem.

- 2017: Over 1,000 cryptocurrencies listed.

- 2017: Bitcoin’s price rockets past $10,000, reaching a peak just shy of $20,000.

- 2018: EOS offers a blockchain-based infrastructure for decentralized apps (DApps).

The Real Value of Cryptocurrency and why the world is paying attention to it

Cryptocurrency is not just about digital coins; it represents a seismic shift in how we think about finance. Here’s why it’s garnering global attention:

- Decentralization: It reduces the need for intermediaries like banks, making transactions faster and cheaper.

- Financial Inclusion: Crypto has the potential to provide access to financial services for the unbanked and underbanked populations worldwide.

- Security: Blockchain technology ensures the security and integrity of transactions, reducing fraud and hacking risks.

- Programmable Money: Cryptocurrencies can be programmed to perform actions automatically, enabling complex financial applications.

Cryptocurrency: Redefining the Future of Finance

Cryptocurrency is a thriving ecosystem, quietly encroaching on conventional finance’s territory. Over the last five years, Bitcoin users and transactions have averaged a growth rate of nearly 60% per year. Similarly, private and public investors have deepened their commitment to cryptocurrencies, including Ethereum, Ripple (XRP), Stellar, and numerous others across the industry.

This burgeoning landscape is reshaping the way we perceive and interact with money, finance, and technology. Let’s dive into a cross-section of cryptocurrencies, stakeholders, and core applications across this sector that continues to grow in importance.

Bitcoin: The Pioneer

At the forefront stands Bitcoin, the original cryptocurrency created by the pseudonymous Satoshi Nakamoto. Since its inception in 2009, Bitcoin has disrupted traditional finance, garnering attention from both individual and institutional investors. Its decentralized nature and fixed supply of 21 million coins have positioned it as digital gold and a store of value.

Ethereum: The Smart Contract Revolution

Ethereum introduced the concept of smart contracts in 2015. These self-executing agreements with predefined rules have opened doors to decentralized applications (DApps) and the rapidly growing DeFi (Decentralized Finance) sector. Ethereum’s blockchain is the foundation for a multitude of innovative projects.

Ripple and Stellar: Cross-Border Payments

Ripple and Stellar focus on facilitating cross-border payments. Ripple’s network is designed for financial institutions, while Stellar targets individuals and small businesses. Both aim to make international transactions faster, cheaper, and more accessible.

Altcoins: Diversity and Specialization

The cryptocurrency space boasts thousands of altcoins (alternative coins), each with unique features and use cases. For instance, Litecoin is known for fast transactions, Cardano focuses on smart contracts and sustainability, and Polkadot connects different blockchains.

Investors: From Retail to Institutional

Cryptocurrency has attracted a diverse range of investors. Retail investors often buy Bitcoin and other cryptocurrencies as a hedge against inflation or for long-term investment. Meanwhile, institutional investors, such as hedge funds and corporations, are increasingly allocating capital to digital assets.

DeFi: Decentralized Finance

Decentralized Finance, or DeFi, is a thriving ecosystem built on blockchain technology. It offers services such as lending, borrowing, and trading without traditional intermediaries. DeFi platforms like Uniswap, Compound, and Aave enable users to interact with cryptocurrencies in a permissionless and trustless manner.

NFTs: Digital Ownership

Non-Fungible Tokens (NFTs) have gained massive popularity. These unique digital assets represent ownership of digital or physical items, including art, music, and collectibles. The sale of an NFT by digital artist Beeple for $69 million made headlines in 2021.

The Future of Finance

As cryptocurrencies continue to mature, they are redefining finance by offering alternatives to traditional systems. Whether it’s through Bitcoin’s store of value, Ethereum’s smart contracts, DeFi’s financial services, or NFTs’ digital ownership, this ecosystem is reshaping the financial landscape. It’s a revolution worth watching, as it unfolds quietly but surely, altering the way we perceive and engage with money, investments, and technology. Cosmofeed is here to provide you with the latest insights and updates on this dynamic journey into the future of finance.

5 Key Players in Crypto Landscape

The crypto world is bustling with innovation and competition. Key players include:

- Bitcoin: The original cryptocurrency and digital gold.

- Ethereum: The pioneer of smart contracts.

- Ripple: Focused on cross-border payments.

- Litecoin: Known for its speed and scalability.

- EOS: A platform for decentralized applications.

The Big Picture

Let’s zoom out and look at the big picture:

- Privacy: Cryptocurrencies offer varying levels of privacy, allowing users to choose the level of anonymity they desire.

- Access: Crypto provides financial services to anyone with an internet connection, leveling the playing field.

- Efficiency: Transactions are processed faster and at lower costs compared to traditional banking.

- Security: Blockchain technology ensures data integrity and protection against fraud.

- Programmable Money: Smart contracts enable automated and trustless agreements.

Are cryptocurrencies legal? (in the USA, Asia, and Europe)

The legality of cryptocurrencies varies by region. In the USA, they are generally considered legal, but regulations are evolving. In Asia, countries like Japan have embraced crypto, while others remain cautious. In Europe, regulations differ from one country to another. Stay informed about the legal landscape in your area before diving into crypto.

Is crypto a safe investment?

Cryptocurrency investments can be lucrative but come with risks. Prices can be extremely volatile, and scams are prevalent. It’s crucial to do thorough research, diversify your portfolio, and consider consulting a financial advisor.

How to invest in Crypto

Interested in entering the crypto market? Here’s a simplified guide:

- Research: Understand the basics of crypto and different investment options.

- Choose a Wallet: Select a secure wallet to store your digital assets.

- Select Exchanges: Sign up for reputable cryptocurrency exchanges.

- Diversify: Don’t put all your eggs in one basket; diversify your investments.

- Stay Informed: Keep up with crypto news and market trends.

The most famous crypto

Bitcoin, often referred to as digital gold, remains the most famous and valuable cryptocurrency to date. Its pioneering technology and role in reshaping the financial industry make it a standout in the crypto world.

Conclusion

The future of finance is unfolding before our eyes, and crypto is at the forefront of this transformation. As it continues to evolve and gain traction, it’s essential to stay informed and make wise investment decisions. Whether you’re a crypto enthusiast or a curious observer, Cosmofeed is here to provide you with the latest cryptocurrency news and insights to navigate this exciting journey into the future of finance. Join us in exploring the limitless possibilities of crypto!